Scroll down to see the Summary view timeline for a Reg A+ offering via Convertible Notes

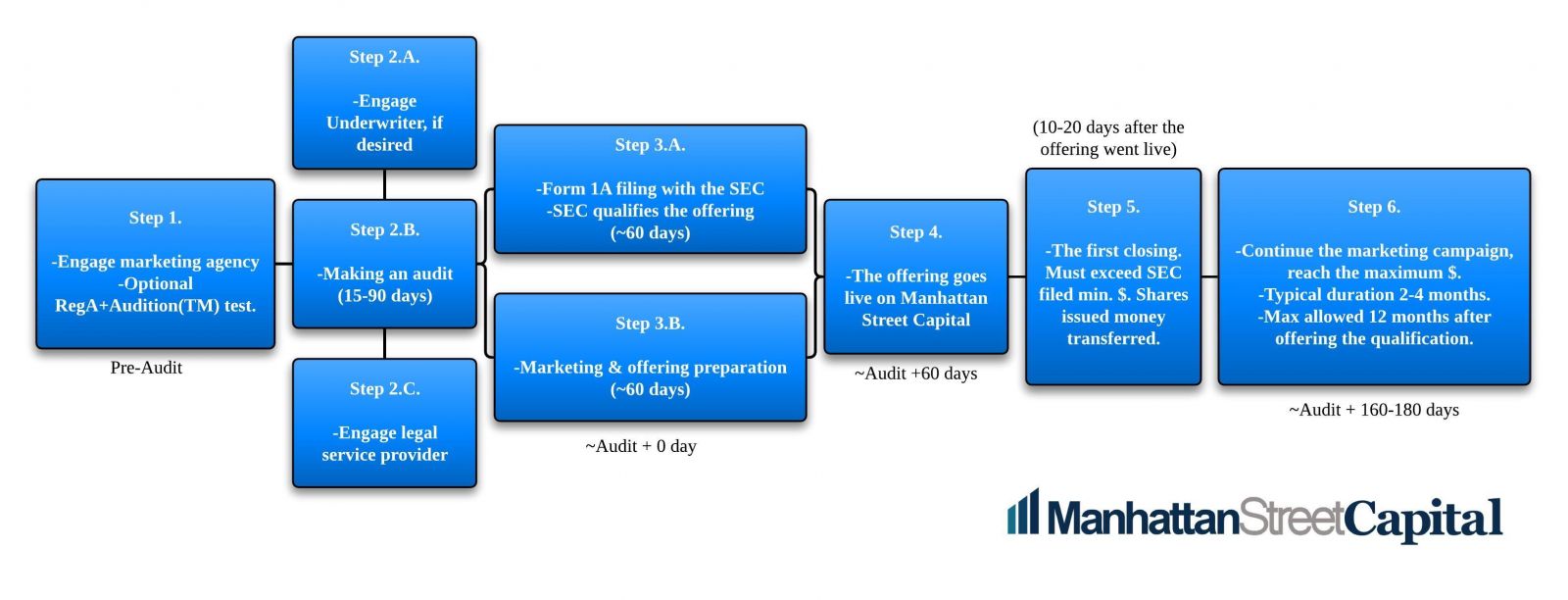

Schedule for a typical Reg A+ offering

Step 1 Select a marketing agency that will manage your 360° marketing campaign. We will introduce you to experienced marketing agencies. If the company's consumer appeal is not clear, we may recommend doing a RegA+Audition(TM) prior to the offering.

Step 2a The company decides if to use an underwriter/broker-dealer (optional)

Step 2b MSC introduces the company to suitable Auditor with experience in Reg A+. The company selects, contracts, with the auditor and gets the audit underway. This item is critical path because the initial SEC filing cannot be started until the two-year audit is complete. Audit duration will depend on the structure and how new the company is. ~15 to 90 days likely.

Step 2c Audit underway, sign up marketing agency and legal service provider, they start preparation. Legal service gathers documents from you and begins preparing Form 1-A.

Step 3a Form 1-A Filing with SEC, in parallel with the Marketing agency building the offering pitch on Manhattan Street Capital. SEC filing can take 60 days when conducted well with rapid responses to SEC questions. Work starts while the audit is ongoing. (The SEC qualification depends on several factors, it can take more or less than the estimated time.)

Step 3b Marketing agency builds offering pitch on Manhattan Street Capital, video, PR, graphics, social media accounts, advertising.

Step 4 SEC Qualify filing and the company go live to investors through underwriter on MSC. Start the acceptance of capital. ~Audit+ 60 days

Step 5 First Closing when $ raise is sufficient, judged by the company if it exceeds SEC Qualified minimum. The initial escrow fund deposits are transferred to the company's accounts. The SEC will Qualify offerings with zero minimum in many cases.

Step 6 Marketing continues till you decide you have raised enough capital, but no more than the maximum $ the SEC qualified. Say a further 3 months to get to maximum allowed. Maximum time allowed under one SEC filing is 12 months. The company may pause their offering and reopen during this time. ~Audit+ 160-180 days

There are many aspects of the schedule that are adjustable according to confidence and success level. This is a Summary schedule that is condensed and simplified. Each offering is unique and timing will differ.

When the Qualified offering goes live, until the minimum $ accepted by the SEC is reached, no money flows to the company. The SEC has shown to be open to zero minimum offerings, which helps in this regard.

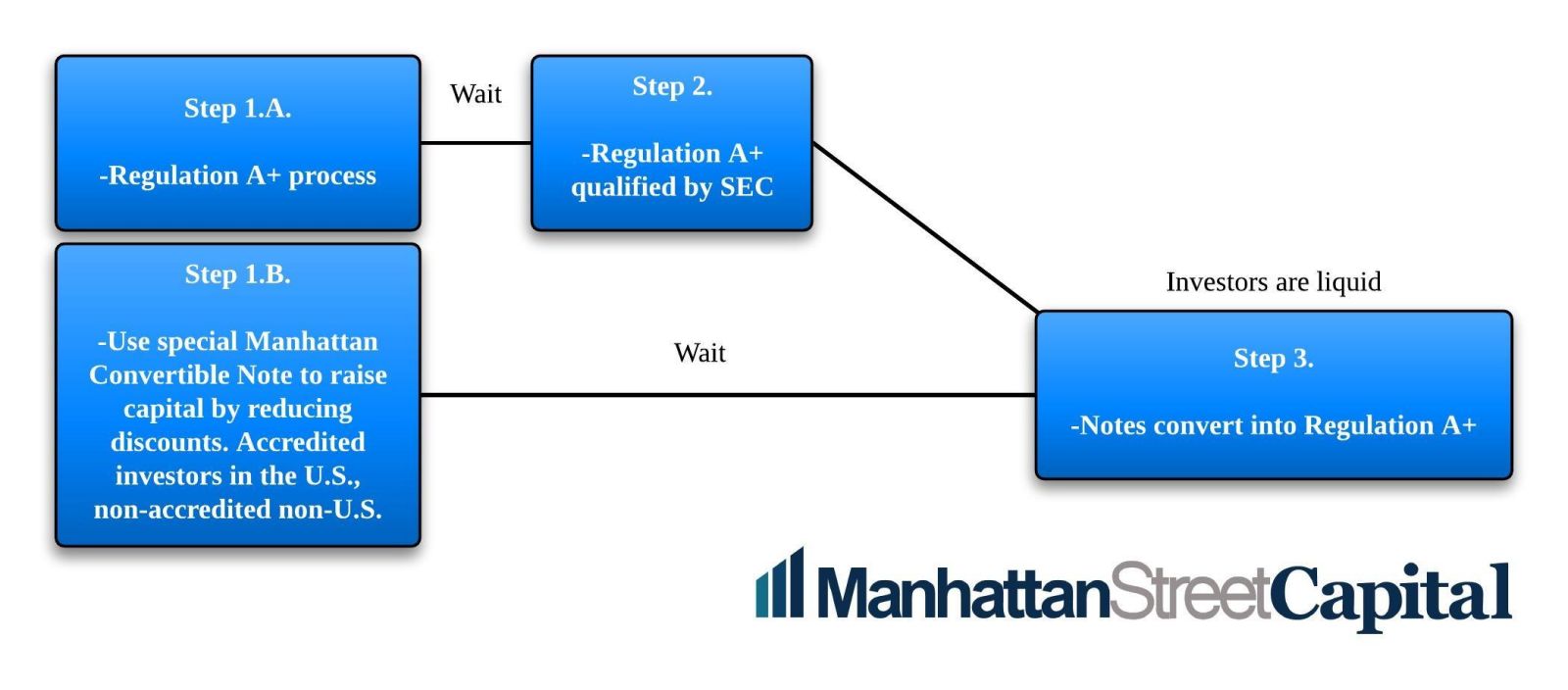

Summary view timeline for a Reg A+ offering via Convertible Notes

Step 1a Start the Reg A+ process. Two-year Audit (if your company has existed for less than 2 years, the audit period will be the age of your company). After the Audit is done, file the Form 1-A with the SEC.

Step 1b Prepare the Convertible Notes. The offering goes live on Manhattan Street Capital, market the offering, raise capital up to $75 million with the Convertible Notes. The issuer company is allowed to give discounts to early investors and during the offering, gradually reduce these discounts.

Step 2 The SEC qualifies the offering. The Noteholders have an exit route if the SEC does not Qualify the Reg A+.

Step 3 After the SEC Qualifies the offering, the Note owners become Reg A+ investors and their Notes convert into shares. The shares are considered liquid securities, the investors can sell them without a holding period.

Related Content:

How much does a Regulation A+ offering cost?

Timeline schedule for Reg A+ IPO to the NASDAQ or NYSE

What types of mid-size companies are best suited to Regulation A+?