Regulation A+ offers companies to raise $75 Million per year from the public - both from accredited and non-accredited investors worldwide.

Regulation A+ dramatically improves the funding and liquidity prospects for companies that want a more practical and cost-effective way to raise capital or to IPO on the NASDAQ, and to retain control of their company. It has completely changed the capital raising landscape; Reg A+ also offers other attractive listing options after the offering completes. Regulation A+ is ideal for companies with strong consumer appeal and a large and happy customer base; these make a successful Reg A+ offering much less expensive to market.

Reg A+ is also called a Public Offering because, during and after the offering, the Regulation A+ shares are considered liquid by the SEC. There is no lockup period unless you impose a lockup for your company. It is not a requirement, but Reg A+ can be used to take a company public and list on the NASDAQ or the NYSE. A Reg A+ IPO is much more cost-effective than a traditional S-1 IPO and takes far less time to process by the SEC. We have had clients of ours get Qualified in 9 working days, while the average for our clients as of summer 2022 is about 30 days. It's prudent to project 60 days for a typical company.

Other listing options include the OTCQB, OTCQX, and one of the many new ATS (Alternative Trading Systems). In my view, the ATS option is a very positive development for companies that want to provide liquidity for their investors and founder, but that are not ready for the rigors of the NASDAQ. There is no shorting or naked shorting of securities listed on an ATS. This is a huge advantage. You may not be aware of this, but stock brokers are allowed to put naked short positions on stocked without needing to "Borrow". So they do this and destroy the value of many public companies. The SEC regulation only requires that the stock brokers only have "reasonable access" to borrow. This is very ambiguous and is why the brokers can make naked shorts while you and I as individual investors can not.

Regulation A+ has two tiers. Tier 1 allows $20M, while Tier 2 allows raises from zero to up to $75M. T

These are the main characteristics of Tier 1 and Tier 2:

Tier 1 - Raise to $20M

- Anyone can invest worldwide

- The company can publicly advertise

- Financials are required, but not an audit

- Must satisfy Blue Sky laws in each US state that investors live in - which is very slow and expensive

- No limit on investment amount by main street investors

- Extremely rarely used because of the expense and time involved in getting approved by the States - many of which require Audits.

Tier 2 - Raise 0 to $75M

- Anyone can invest, worldwide

- The company can publicly advertise

- No state registration required

- Requires Audited Financials

- Non-accredited investors are limited to 10% of their annual gross income or net worth

Advantages of a Regulation A+ Funding Campaign

- You can keep control over your company's destiny - One appealing facet of Regulation A+ relative to VC is that the CEO gets to keep control over the company's destiny.

- Customer traction and the credibility it brings - In the case of companies that appeal strongly to consumers, the inherent Reg A+ process of marketing to thousands of investors has additive effects on the company and its brand.

- Liquidity for investors and insiders - Regulation A+ shares are considered liquid and can be resold without any restrictions. You can read about insider liquidity here.

- Early-stage companies and startups can also conduct a Reg A+ offering.

- The Reg A+ makes all stock classes of the company liquid in the eyes of the SEC as long as they have been held past their Rule 144 holding period. So a company can offer its long-standing investors the option to convert to the class of security that it has listed on an exchange, in order to provide them with actual liquidity. (Upon listing on the NASDAQ or NYSE all classes convert to common in any case).

- The fact that the SEC has Qualified the Reg A+ is viewed very positively by institutional investors and strategic partners.

Funding Platform

When conducting a Regulation A+ offering, companies can use the Manhattan Street Capital funding platform to assist their fundraise and help them satisfy the legal requirements. Manhattan Street Capital assists companies through the whole capital raising process to achieve a successful offering. Our website technology integrates the necessary services that are required to conduct a successful Reg A+ offering. The Platform handles the whole online investment process, collects KYC data, runs an AML check on every investor, handles the accreditation verification (when needed), and the company gets access to our investor base.

We List and Advise mid-stage companies and mature startups that we consider a good fit for Reg A+. In our opinion, a company's consumer appeal is the most important factor (once we have established the strength of the management team, a strong strategy, a large and growing market, a rapid growth rate, and barriers to competition). We are selective and we care about the success of our client's offerings and that their investors will celebrate in the years to come that they invested in our client companies.

Testing-The-Waters(TM)

Testing-The-Waters(TM) enables companies to test the market themselves (before making any filing and before spending any money creating an offering) to see if there is enough investor interest to make a Regulation A+ capital raise successfully.

The SEC created this program so companies can make this test before having to spend the time and money it takes to make an SEC filing and get an audit done. The SEC allows companies to market themselves in TestTheWaters(TM) with few restrictions. So companies can cost-effectively conduct a test using social media, email, online advertising, and more. During this process, we provide the ability for potential investors to make non-binding reservations in a company they like.

Secondary offerings

Public companies that are living up to their SEC reporting obligations are allowed to make secondary offerings via RegA+. This increased scope for Regulation A+ has led to more established, already-public companies making secondary offerings via Reg A+, which helps strengthen the ranks of US Small Cap businesses on the NASDAQ, NYSE, and OTC Markets. The resulting increased awareness of Reg A+ from this expansion has further accelerated its use and brought new legitimacy to Reg A+ fundraising.

This marks a significant advancement for the Reg A+ funding sector, which many people believe can accelerate the growth of midsize companies better than any other mechanism, given the fact that it allows cost-effective access to capital via online offerings to investors of all wealth levels, and provides a viable route to growth capital for entrepreneurs whose businesses do not fit Venture Capital or Private Equity, and those who want to stay at the helm of their business. SEC Chairman Jay Clayton offered this statement: "Regulation A provides an exemption from registration under the Securities Act for offerings of securities up to $75 million in a 12-month period. The amended rules will provide reporting companies additional flexibility when raising capital.

Watch our Webinar on Reg A+ Secondary Offerings.

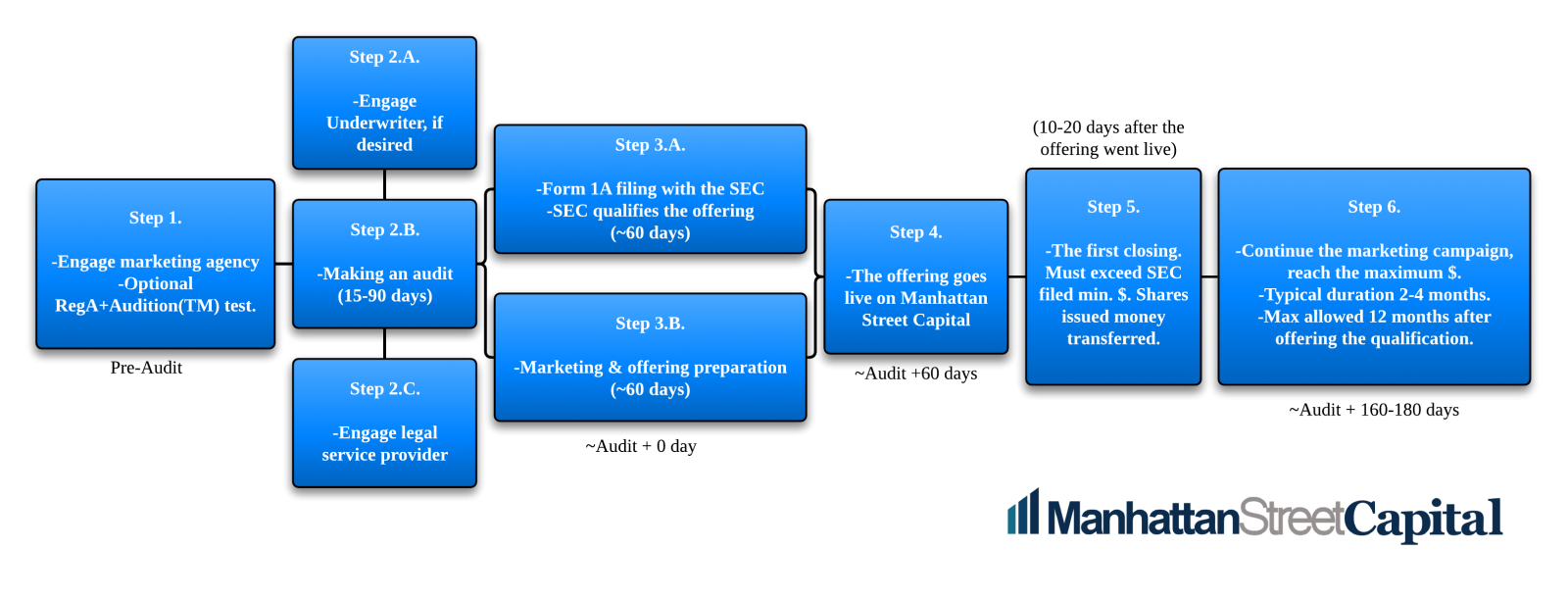

Timeline for a Regulation A+ offering

Step 1 Choose which funding method would be the best fit for your company, it depends on several different factors. Get legal advice on the details. We can recommend you to a securities lawyer. Select a marketing agency that will manage your 360° marketing campaign. We will introduce you to experienced marketing agencies. If the company's consumer appeal is not clear, we may recommend doing a RegA+Audition(TM) before the offering.

Step 2a Decides if to use a broker-dealer to enable investors from the problem states, or to file directly with those states.

Step 2b MSC introduces the company to Auditor with experience in Reg A+. The company selects, contracts, with the auditor and gets the audit underway. This item is a critical path because the initial SEC filing cannot be started until the two-year audit is complete. Audit duration will depend on the structure and how new the company is. ~15 to 90 days likely.

Step 2c Audit underway, sign up marketing agency and legal service provider, they start preparation. Legal service gathers documents from you and begins preparing Form 1-A.

Step 3a Form 1-A Filing with SEC, in parallel with the Marketing agency building the offering pitch on Manhattan Street Capital. SEC Qualification can take as little as a week, with 60 days a prudent expectation. Work starts while the audit is ongoing. (The SEC qualification depends on several factors).

Step 3b Marketing agency builds offering pitch on Manhattan Street Capital, video, PR, graphics, social media accounts, advertising.

Step 4 SEC Qualify filing and the company goes live to investors on MSC. Start the acceptance of capital. ~Audit+ 90 days

Step 5 First Closing is usually made in the first week. Closings can be made whenever the company chooses, as long as you did not establish a minimum escrow close amount. If you are raising capital to buy a building for $10 million, then you cannot draw down capital until you have raised more than $10 mill.

98% of our clients make their minimum raise amount in their filing zero. In that way, closings happen from the beginning, and the proceeds of the raise can be used to pay for the ongoing marketing costs of the offering (as long as the Reg A+ filing was written properly).

Step 6 Marketing continues till you decide you have raised enough capital, but no more than the maximum $ the SEC qualified. Say a further 3 months to get to the maximum allowed. The maximum time allowed under one SEC filing is 12 months. The company may pause its offering and reopen during this time. ~Audit+ 160-180 days.

Costs for a Regulation A+ offering

Total cash costs: A good guide is to expect cash costs of approximately 12% to 14* of the capital raised (this only holds on raises that are above about $8 mill, because fixed costs for things like the securities attorney and audits become a larger factor for smaller raises).

Costs incurred before going live to investors: The primary expenses before going live are for Marketing, Form 1-A legal filing, Audit, Broker-Dealer up-front fee (when a broker is involved), plus payments to Manhattan Street Capital. See below for more detail. We generally recommend that you have at least $150k (assuming a simple audit) available before you begin your Reg A+ so that you can pay all the costs involved (the largest is the marketing content creation and the advertising media spend) before the capital raising process becomes efficient enough to easily cover the ongoing costs of the capital-raising process.

The SEC permits capital proceeds to be used to pay the expenses of the offering in the $most well-prepared Reg A+ offerings. It's certainly possible to start your Reg A+ with less money on hand, and this can work. But having extra money available is a smart move to give you extra runway if the early stages of the offering are tougher than expected. Start with enough cash and be very careful how you spend it (we help with this) so you can adjust as needed and succeed.

To see the list of all the costs in detail, visit our FAQ on this topic.

*NOT charged as a percentage - we use % here as a guide only.

Read our Blog on How To Succeed In Raising Growth Capital Via Reg A+

I am happy to schedule a call with you to help you assess if Reg A+ is a good fit for your company and your liquidity goals, and to send you more information - just contact me using the button below and send specifics on your company and capital raising plans. And in the meantime, I wish you great success!

.jpg)

Rod Turner

CEO Manhattan Street Capital