Use the Chapters list below to select the part of the video you want to watch.

Please read the disclaimer below the index

Chapters:

- What is Reg A+? - Reg A+ investors

- Frequent misconceptions about Reg A+

- Rod's background

- What Manhattan Street Capital does

- Why Reg A+ over Venture Capital(VC)

- Why Reg A+ is good for Biotech - Reg A+ Biotech success stories

- Reg A+ Timeline

- Costs and Marketing

- Broker-Dealers

- Marketing methodology

- Minimum/maximum raise

- Post Reg A+ liquidity

- Reg A+ IPO vs S-1 IPO - advantages and disadvantages

- Mistakes to avoid

- Q&A - Is there a litigation risk because of the non-accredited investors?

MSC is not a law firm, valuation service, underwriter, broker-dealer or a Title III crowdfunding portal and we do not engage in any activities requiring any such registration. We do not provide advice on investments. MSC does not structure transactions. Do not interpret any advice from MSC staff as a replacement for advice from service providers in these professions. When Rod Turner provides advice this advice is based upon his observations of what works and what does not from a marketing perspective in online offerings. Rod does not tell the audience what to do, or how to do it. He advises the audience what is most likely to be easier to market cost effectively in the online context. The choices of all aspects of companies offerings are made by the companies that make offerings.

(1).jpg)

Rod Turner

Rod Turner is the founder and CEO of Manhattan Street Capital, the #1 Growth Capital service for mature startups and mid-sized companies to raise capital using Regulation A+. Turner has played a key role in building successful companies including Symantec/Norton (SYMC), Ashton Tate, MicroPort, Knowledge Adventure and more. He is an experienced investor who has built a Venture Capital business (Irvine Ventures) and has made angel and mezzanine investments in companies such as Bloom, Amyris (AMRS), Ask Jeeves and eASIC.

www.ManhattanStreetCapital.com

Manhattan Street Capital, 5694 Mission Center Rd, Suite 602-468, San Diego, CA 92108.

THIS TEXT TRANSCRIPT HAS ERRORS IN IT THAT WERE CAUSED BY THE SPEECH TO TEXT CONVERSION SOFTWARE WE USED. DO NOT DEPEND ON THE TEXT TO BE ACCURATE. WATCH THE RELEVANT PARTS OF THE VIDEO TO MAKE SURE YOU ARE PROPERLY INFORMED. DO NOT DEPEND ON THIS TEXT TRANSCRIPTION TO BE ACCURATE OR REFLECTIVE OF THE STATEMENTS OR INTENT OF THE PRESENTERS.

So what is Regulation A+ fast? I expect quite a few of, you know, but, uh, anyone anywhere within reason in the world can invest. Um, the sec considers those investments to be liquid post-purchase of the securities. The sec considers this to be a public offering once completed, um, not an initial public offering, but public offering with a P and O uh, because you are selling shares to the public and you have some reporting obligations that go along with that to enter into it. You need, uh, two years of gap audit. If your company has existed that long. And, um, you can raise up to up to $50 million in one offering over a 12 month period. And again, anyone can invest, it don't have to be wealthy. Anyone's allowed to invest. Interestingly, the nature of the investors in Regulation A+ tends to be quite different than one would expect certainly different than in a reg D offering. Um, I would say generally they are optimists. And you can tell that by a couple of these indicators, 60% of the investments now coming in via smartphone, which itself is interesting and out of a hundred people who will end up investing in a Regulation A+ a about one or two of them will invest on their first visit to the offering page. You know, this is clearly optimism, and I see the comments coming in to our issue with CEOs, uh, and uh, sometimes they come to me, they're indicative of optimism as well. Interesting.

They could invest in four to six minutes and move on. So that's a nice thing about it using their smart phone or their tablet or the computer. The reasons they invest, that's where it gets interesting. And I'll get into that more in a moment about biotech, could this more directly relevant to this audience, frequent misperceptions about Regulation A+ that I want you to be clear on before we go further. One is that it, you have to do an IPO. Absolutely not the case. Uh, you do not have to list your company anywhere. Okay? You don't have to do an IPO. You don't have to list it anywhere else. If you do choose to list the company on an OTC markets, then you are, uh, only obligated to have a annual us gap, uh, audit, which is a relativity we're required to in the case of the OTC QB produce. The same thing that Regulation A+ requires is which is, uh, can you guys hear me? All right, I'm going to get indication that the mine network connection is marginal. Okay.

Management financials, annual gap audit, if you are not listed or it's all listed on the OTC markets, if you go to the OTC QX, they will want a quarterly management financials, but it's still one us gap around them, which is let's face it a very lightweight obligation compared to having a PCA of, um, tier one is a, is a, is a mistake. Really, I'll get into mistakes later on the tier one is a waste of time in almost all cases of regulated class. Um, you are allowed to the flexibility in a Regulation A+ is something that people don't aren't aware off. Um, you know, I don't recommend people do it for less than $4 million because of the expense and the workload involved. But, uh, you could go into a Regulation A+ with a given need and expectation and increase the size of the raise that you make during the race, as long as you established a large enough maximum.

So I'll talk more about that later on, but the sort of misperceptions that people have though, is it okay if we're pre-revenue? Yes, it is. Do I have to have half a company history of eight years? No, you don't to do a Regulation A+ one. Um, how big, you know, do I have to have a task to thousands, you know, 12 to 12 executives and 200 employees? No, you don't. And really what it comes down to is is that early stage companies can have great success using Regulation A+ when what they're doing is very attractive. And of course the caliber of the people involved is strong in the technology, or the product is strong and has barriers to entry, uh, et cetera. So it isn't necessarily to be a big company already. It is necessary to have some money to pay the costs of doing it and I'll get into what it costs and things later.

But, um, biotech companies let's face it. You know, if a biotech company has already bought FDA approval than if the product's successful, they've already, you know, they're already gigantic or they, or they were back to get bought at the companies that we see in Regulation A+, uh, all the ones that are a bit earlier on, you know, that preclinical there in most cases. And, um, they it's okay to do that. You know, if it's appealing enough to the investors, it doesn't matter that it's going to take some time to get through the FDA process, uh, in order to go to market.

Regulation A+ venture capital, of course, you know, there was some lovely things about venture capital. Some of the, some VCs are phenomenal people. I've had the good fortune to work with some of the best Silicon Valley VCs in some of my earliest start-ups and my God. I didn't talk about me at all at the beginning. Well, I will, I won't break. I'm going to pause for a moment and give myself a little bit of credibility here. I hope so. You'll listen, although I hope you're already listening and, uh, uh, explain what is the capital does because I skipped that was unintentional. So, I've had the good fortune to be a founder or top executive, a senior executive at six prior tech start-up companies that we built to scale two, we took public to the NASDAQ Symantec with its, uh, with the Norton anti-virus is the better-known company, the more recent company of the two.

I've also formed a venture capital firm in the passport Irvine benches based in Irvine. What's surprised that was, uh, interesting as well. I was in the pre, um, in the, in the first internet bubble, very expensive experience at the end of the day, but learned a lot. So, I have a lot of relevant experience. I'm an engineer that's managed to learn the other skills necessary to, uh, to be a successful leader. And executive. I ran the largest mergers at Symantec, which were a very challenging and very, very worthwhile. Um, and what Manhattan street capital does? We, uh, I launched the company five and a half years ago because of Regulation A+ to raise money and Regulation A+, because in my opinion, when it hits strive, which is taking longer than I thought it's a 40 to $50 billion a year capital raising market.

And there's so much good that we can do in helping companies raise money that otherwise couldn't all that otherwise couldn't in such an attractive manner. It's really worthwhile doing this. Uh, I could retire, uh, I had a retirement phase early on. I've had a lot of good fortune with my career, but sticking to the straight and narrow here, Manhattan street, capital exists has been in existence for five and a half years focused on Regulation A+ we do reg D offerings as well. Um, we are an offering platform and consultancy that helps companies decide if they should do it in the first place. Right. You know, that's the first thing companies engage with us to find out if it could work, if it could have, because the last thing we want to do is be a part of taking companies, sort of an offering process that will fail or struggle.

So we're up front qualifying companies and helping them figure out if this is even a good instrument or reg D is, or if they should do something else, that's sending them off in another direction where appropriate. And we are a funding platform with great depth and seal activities. We're selective. The platform is very deep. There's a lot of things. It does that basically build on the fact that I'm an engineer, right. You know, we have an algorithm built in that tracks everybody's activity at all times in order to identify risky investors. You know, that was an idea I had before I started the company because I like the idea of a free form context, I had was accurate reviews. You know, use that in a different context to figure out, uh, the behavior of people and have it indicated whether or not what they say is, is, is valid.

And this application reduced litigation risk by identifying risky behaviors in potential investors, in our companies, our clients, companies, client companies, um, I won't belabor the point. So how wonderful the platform is, but we are, it is a wonderful platform, but I'm not, I'm not here to sell you guys on that. I'm here to, to inform about Regulation A+, and if you want to look further great and we'll get into that later. Okay. So, Regulation A+ you don't have external board members seats to, you know, powerful people that have a lot of clout in your company. So, you are more likely to stay on board as the CEO and be able to adhere to your strategy right or wrong. Right. I mean, there are times when they're evaluated up, there can be really useful. So, it's not a complete no-brainer and much less dilution because in a, in my experience in a reg D with angel investors or VC, that's, you know, that it's a fair deal.

You raise enough money to grow the company a year and a half. You're going to give up 25 to 33% ownership in the company. And then when you do it next, next time, when I have the same kind of dilution and last year, you know, experiencing very, very rapid growth. So lots of dilution there, and a lot less dilution and a Regulation A+ if you look at the numbers and observe what kind of valuations Regulation A+ offerings that are legitimate, and that, uh, are well received and accepted carry there's less dilution. Okay. Um, I'm not a valuation professional, but let me just leave it at that substantially less dilution, uh, as well as liquidity, you know, we have venture funded companies approaching us because of the seasons produce them because they want to get liquid. And, you know, there's reasons with VCs where, um, they funded as much out of fund two is there as they can, the company still needs money to grow, and they aren't allowed to use fund three, four or five to put more money in the need to get other investors in, or they need to raise money through another method.

So we've had VCs come to us. I have a pretty, I would say I have a tremendously good, uh, contact network in high-tech, you know, not too many of those companies that have been those that would do well in a Regulation A+ so far, frankly, but some of them, some of them can and will obviously, you know, will over time that will become a viable and effective portion of our business. It's a matter of which companies went, right? So liquidity is a big advantage in Regulation A+. And I'll get into that further later on because there's some pleasant surprises beyond the obvious there. Why is Regulation A+ good for biotech? Uh, in our, in our, in my experience at Manhattan street capital, our two biggest segments of exciting company offerings and offerings that we're bringing to market are biotech and med tech and real estate real estate is obvious and easy to understand, you know, the big raises in Regulation A+ do tend to be in more of them than anyone else, anywhere else in, in real estate. But biotech is where I see for men there's opportunities, or we've been sort of pushing to do more biotech companies. We have some exciting companies going live with us soon.

I've got to be careful that I can't, I'm not allowed because I'm not a broker dealer. I am not allowed to pitch any of our client companies, right. So I can describe them in a linear fashion, but I must not pitch them. I must not try to sell them to you or anyone else.

I'll tell you about a couple of the companies that we have, uh, that will be going lower than a biotech. One makes humid insulin, um, with a it's enough going to an overnight success, eight years in the making proprietary incident process, they will be selling it for 70% less than the market price of in the us. I love that personally. And I think a lot of investors will want to back that company. We have another company which has, we have two companies that have different COVID-19 tests. That they're one is closer than the other to going live. Each of them knows about the other. Obviously I introduced them to make sure that the newer of the two, uh, and the one that's already in our system, we're happy with each other to make sure that that wasn't going to be a problem. One of the nice things about and seed capital is that if you do a Regulation A+ process with us, your offering is isolated within our platform. It's isolated from everyone else's offerings. There are no buttons saying, click here to explore other investments. You know, we don't do that kind of thing. We don't allow that kind of thing. Right? So you're the money you spend bringing in investors doesn't get filled stuff into other offerings. Um, so those are two examples. There's some really neat companies are the ones that are, I won't

Describe because that's not the purpose of this presentation. So why biotech is, can be great in Regulation A+ well, people care and there's high awareness, right? That's the primary. Okay. If it's a B2B business and it's boring and hard to explain, it's not unnatural for Regulation A+ right. Then if it's going to work, it's because the company has substance and it's paying a decent dividend. And the dividend is what attracts investors and the substance is what makes them feel like, okay, this is an okay company to, to invest with because they're going to stay open and they can that they're going to be able to continue to deliver the dividend payments that I would love to experience. Right. But, um, if it's going to be an equity sale, then it's got to be simple to explain. And it has to be really E it has to be really engaging.

So we did a Regulation A+ for a company insights to biologics and non-opioid pain killing, uh, the pre preclinical. Um, their first version of the product is a of their technology. If you will, is a, they can deliver a lot of things with their technology. The first example is delivering a pain medicine for surgeons. So surgeons just before they stitch up their patient, they insert the, this gel biodegrades and is biocompatible to human beings. And it slowly delivers the painkiller where it's needed. So you don't have to pop pills. So it avoids the opioid risks. So this is a really exciting company. Um, we had great success in their reg D and then great success in their Regulation A+ in part, because we were working very well together. And the marketing agency did a marvellous job on improv because it's an engaging offering, easy to explain.

And the opioid epidemic is a huge issue in this, in the U S especially. So it resonated with the audience, that case, the, the average investment amount was about $8,000 because so many physicians and a niece desist invested, which is unusual, right. That was very appealing to them and obviously can apply to other biotech’s, but it appeals very broadly to consumers as well for the obvious reasons. So consumer empathy. Yeah. I want that. I want a cure for Alzheimer's. I want it, I want to have a cure for triple, triple negative breast cancer. Uh, I want to, fix it. I want to fix diabetes people care, right? And of course, they see the financial upside too in solving some of these huge problems that need to be addressed. So when it's understandable and easy to convey in an online advertisements on social media, that is when it clicks and when people care so much the bathroom, if it's, you know, there are things that we've, you know, there are companies in biotech that I've advised not to use this method where there is no way to, to depict what they do in a way that doesn't revolt you and turn you off your make.

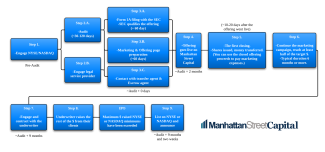

You want to throw out your laptop or throw away your phone, because it's so disgusting, even though it's doing something really worthwhile, you know, there've been those examples, but when we're doing things that people care about that are not that ill, then, um, biotech's wonderful. And I, I, you know, I just feel that biotech companies have the right Stripe are the examples where Regulation A+ really kicks into gear and can be a super tool to use clearly big path to financial, outside of things, in a swath of investors. You want that? Okay. So now I'm going to touch on the Regulation A+ timeline and costs. And then, you know, I'll get into some of that in more depth later in different ways, but essentially, it's two months to prepare the offering two months to get it through the sec. As long as it's being prepared properly by a security attorney that knows their stuff.

We bring all the service providers to the table that are experts in their field. And that saves a lot of time. And also, especially with the sec, when those attorneys are respected by the sec Regulation A+ people help. It helps you don't want to be learning on the job really with that or anything else. So, auditors attorneys, marketing agencies, where relevant broker diggers, you name it. We bring the service providers in direct. There are, you are their clients. All we do is introduce them, make sure it's going to work. Otherwise, we wouldn't have introduced them in the first place, make sure they get it and they understand what they're doing and that you're getting a good deal. And there are no backdoor deals with us. You know, we are a, I suppose, an honest broker as the right term for them. So, four months to qualify as reasonable if you're on it, not, you know, falling asleep at the wheel or getting distracted.

And, um, once we go live in month five, then you have a year to raise money. You can pause the offering. You can change the security price. If it's an equity offering, as you go, um, up to 20% cumulative share pricing increase is allowed in a very, very simple notification method. You wouldn't do 20% in one step necessarily, but that's the amount that you can do where you notify the sec and you have 48 hours to go live with it. Uh, if you want to do more than that, then you pause the offering, apply to the sec. And, uh, if you do nothing else, you'll get a quick turnaround. And during that time, you do pause the offering in order to do a more substantial share price, change, like a share split or something like that. The reason I mentioned this is that a huge percentage of the companies that approach us to do Regulation A+.

Plus, there's a number they need. There's a number they want. And then there's the unpredictable, right? So, a company that needs $12 million, then of course they should be pricing your offering according to how much they need. That's, that's the right thing. But my recommendation is to set the maximum to 50 so that if the offering goes really well and the money raising is really easy, then say at the 12 and the point they make a substantial revaluation of the valuation significantly in order to raise more money in a managed state of dilution. And if there's good news and acquisition comes along with some other thing where it's prudent use of funds and you want to raise even more money, something apart. So, having that flexibility is one of the great strengths of Regulation A+. Frankly, the ability to dynamically adjust the key terms. You can't adjust the maximum once.

You've got a qualified though, you can't go back and say, you go with a high number in the first place to give yourself that flexibility. Okay. So then, um, costs just the, sort of the bird's eye view of it is that for a simple entity, this is old. It's very greatly like if you've got a complicated business company with revenue, you know, with all sorts of subsidiaries and things that I have no clue sitting here right now. Well, your audit cost is going to be, even though it's only us cap, of course, right. It could be expensive and slow, but in a simple case, then it's, you know, it's a modest amount of money. So, 150 K is sort of the minimum you should be considering to be the cash cost to reach the point that we're live to investors in month five. I wouldn't want you to depend on that.

I would like you to have more money on hand, but that's the minimum you can really do. Okay, good. Get a little lower, you know, but let's not waste time pressing about perfecting it under the 50 gays, a bad, the minimum you're really going to get away with in most cases, unless you already have an audit, unless you just forget the exceptions. So now you live and in the first month tip, I'm talking typical situation. You know what biotech company that hasn't released their product yet has a ginormous fan base or huge customer base. If you do, then the marketing can be almost free, but there aren't very many biotech companies that are in that situation. So, I'm not going to talk to that very much here, um, in the realistic situation where we don't have a big fan base to deal with going at and creating momentum from the Manhattan street capital member base and from the great unwashed masses, you don't know yet about how you, how marvelous your company is.

That is where the social media advertising comes in. And we'll typically recommend that. And the agency will recommend the same that you spend about 10 national dollars in advertising, uh, during the first month, because we don't know what we're doing. Right. But testing, uh, Lakoff, somebody's waiting on, okay, you go, we don't know what we're doing yet. Right. We know we don't know we're tuning and testing and adjusting as necessary to target audience, the nuances of the targeting of those different audiences, the advertising and the nuances of the appetizer. All of it's being tested. The key messaging on the landing page on Manhattan street capital is being tested. We might have three or four different landing pages in the early days. If we don't know, you know, if we really are looking at the messaging and we think we don't know where we're at yet, right?

All of them going into the same backend, all of them handling investments the same way, but having a different lead message, which we're testing with a lead ad campaign with a particular audience, don't normally need to do that, but that's a feature that we can, we can do it, right? So, the point being that the efficiency is not there in the first month, typically, you know, Regulation A+ processes, we see companies raising 30 to 30 to 50 K on that 10 K span, even in the first month where we don't know what we're doing, which is horrendously inefficient for a big span, but for a test spend up front, is it isn't too shabby. Then we increase. We recommend that you increase the span as the efficiency increases. It's all about getting that marketing efficiency higher and higher and higher, right? So as the offering continues, there are some built-in characteristics that make it more efficient.

We build a bigger and bigger and bigger audience of people that have invested. And those that have not, and it's commonplace for people to invest a small amount early and then monitor it and then come back and invest a chunk more, and then come back from their managed IRA account and put in 30 K you know, that kind of thing is, is not unusual. So as the credibility of the offering continues to grow as the interactions and proof that it's real continues to grow. There's a lot of things we do to encourage our companies and help them do those things. Then the average investment amount increases and the efficiency of all the marketing, uh, increases that's the norm. Okay. So, what does that mean? I mean, in a Regulation A+ that that is say 10 million and above, you should expect that the total cost, if it Raleigh talking about ones that should be done, right, but not doing this, if it shouldn't be done, that's clear cut.

We have that discussion upfront. If we're doing a deal that should be done in the sense that Regulation A+ process is a good instrument for it, then 12 to 12%, maybe 14% cost of capital, maybe 10%. If we're lucky, the best that we've experienced ourselves is six and a half percent total cost. But please don't tell your friends about that because you know, it ain't going to happen again, right. That was a perfect world situation. So, you know, realistically 10, 12, 14, 14% worst case is what I would expect as being the total cost of a sizable Regulation A+, you know, around 10 million and obviously the higher, the amount, then the efficiency you can get higher and higher. Um, let me see here. That's cash costs. Yeah. If there's some war on cost for us, and if there's any broker dealer involvement, then it gets more expensive and there's more warrants involved.

Okay. So that's a bird's eye view and expenses and timing broken dealers. The thing to know about broker dealer involvement in a Regulation A+ is that there are the really only three ways that you involve broker dealers, you know, IPO today. We involve them as underwriters at the right time. It could be at the beginning, or it could be after we demonstrated that this is a kick success. That is when they'll go to bat for us. So we engage them then, um, that's for an IPO and that's a whole different puppy. And we, uh, happy to do those. We've done those in the past with Regulation A+ and a non-IPO. Then there are two other ways in which we use a broker dealer. If we reach a point where it's already a very successful offering, but we're finding it more expensive to market instead of less, because we've tapped out the easy to reach audiences. We haven't had bad experience yet.

The time to add a broker dealer role, too. Right. And by that time, because we're already successful with the rays, they will love to jump on board and make it happen. Right. And get involved, really not just flirt with the idea because at the beginning involving broker dealers to raise money is a waste of time because their reps will not take the risk of reaching out to their clients when it may or may not succeed. Right. It just stands to reason. And it's a fact, they don't want to burn their client relationships by making recommendations that might come back to hold them. That's why, if you're going to do it this way, you do it later where they're raising money. When they're chomping at the bit, beating down the door and we'll get a better deal altogether, the cash up front will be lower. The commissioners will be lower and they'll actually do the draw.

That's the right way to go. The other need for them is that, um, because there are seven States that are not all saying essentially like essentially you can, you can file with those States as your own broker, but not really in Florida. I mean, Florida is Florida and Texas are the two that matter. The most you can get in, you can do it successfully with Texas and inferior. You can with Florida. But in point of fact, in Florida, that securities department is overloaded on. They have a hiring freeze and they don't like Regulation A+. So, you know, you're not likely to get Florida by the direct approach. So, if you really want Florida and its sizable portion of the investing public, then you need a broker dealer on the offering to do, to open up those problems. Particularly Florida, we don't need them day one, because day one we're testing.

And, you know, we just take reservations for Florida, right? In terms of managing and optimizing cash, there was, there were two issues about using a broker dealer in a Regulation A+ from the get-go one is that the sec may have qualified the offering. But if they FINRA, hasn't blessed, the broker dealer terms, they won't qualify the offering. They wait on FINRA. So, to avoid a delay, you can go live, you write up the offering, circular, the offering is written without a broker dealer involved, you go live, it's qualified. And then immediately afterwards, or a week later, or a month later, or six months later, you add the broker dealer with any FINRA delays, don't impact the offering, no relevance because you're already qualified. So, cash cashflow wise, you know, even we, we have a 1% broker dealer that took me four and a half years to find and cause that to occur for us, um, where they're charging 1% or all capital raise, but they're a really good firm and they have an upfront fee.

That's 25 K. Maybe you can negotiate. We can negotiate it lower. They have an eight K FINRA fee. If you're really worried about gas, you don't do that until we're already raising money. Fair enough. It depends on how much, you know, how much cash matters and is they really going to cause much of a delay with FINRA if their filing is done early enough because they're 1% fees, so easy to blast them, they do a lot of deals with us for Regulation A+ , okay, don't forget. You can post questions if you have them, which I will attempt to answer towards the end of this event and how are we doing on time? We're doing good. So, marketing methodology, I've touched on some of it already. Um, really, I have I've hit the main points there. Um, there are some lists that we have access to, uh, uh, investors that sometimes we're generally renting and buying list, isn't that successful venture?

Our list is one is a different story. Of course, when an offering is live with us, then we promote it to our social media following, which is quite large. And to our member base, except those investors who are currently involved in another offering that hasn't completed because you got it earlier, they're off limits, but we do that. And that helps, but that is never the solution, unless we would have gotten insanely lucky because of some of my contacts or something, realistically, you're not going to raise megabucks from our user base. Maybe that's going to be 10%, 15% of the raise, but not immediately, right? Realistically, the offering succeeds or fails based on the outreach marketing, which is where we at all. I get heavily involved with the marketing agency. The marketing agency selection is absolutely critical. We have three agencies that we know and love and work with are excellent at this.

There are too many agencies out there that aren't very good to waste time, waste money, and especially some bigger agencies with a good name and have a good reputation because of prior successes and Regulation A+ a big charge too much. You know, maybe there they'll tell you that you have to spend 10% of the raise on the advertising and then their fees are 10%. So now you're at 20% and you haven't covered any of the other expenses yet. And that's what they say coming in, you know, and then it'll be worse than that because of course, you know, that was their initial goal. So, we don't touch those agencies with a 10 foot barge pole for obvious reasons. How do you get investors are already sent down?

Unless you're buying something, set it to zero. Yes. He sees happy to do to qualify Regulation A+ if they prepare properly where the capital raise minimum is zero, let's say at the end of the first week, there's $10,000. That will be more than usual with a 10 K month span, but let's say 10 Ks in or five K's in. And you'd like to test out the escrows. It's not as for really, you know, the segregated account transfer process. You do it and you move the money over right away. You can do it daily. If you want weekly, monthly, it doesn't matter. You certainly don't wait to bring in funds unless you have an escrow minimum because you're buying something or you decide that it's only worth doing this raise. If we raise more than 20 million, that's a nightmare scenario, because then you have to spend every dollar of expense to raise 20 million before you can close escrow. You know, please don't do that unless it's truly the case. That that's the only way that the raise makes sense. And then how the heck do you find it? I don't know, but that's not something that we want to have to entertain. And as we can avoid it, legitimately maximum raise set is high 50 milliliters. The current max as CCS, thinking about raising it to 75 million. We'll know when we know broccoli, we covered post Regulation A+ liquidity. This is interesting things here.

Dig from the SCCs perspective. As I said earlier, the Regulation A+ investors are liquid. Pretty much everyone knows that, but everyone else liquid two guys. So, the founders and all long-term investors, everyone else is liquid unless you lock them up, but you may end up wanting to do, but that doesn't mean there's liquidity and is easy for them to sell, but they are allowed to sell to anyone in the general public. It doesn't have to be as sophisticated investor, obviously is Regulation A+ itself. Doesn't require that, right? So, if there, if these investors have exceeded or shareholders' founders have exceeded that rule one 44 holding period, then they could, it is really cool with the following constraints, the insiders and the investors that are more than 10% of the outstanding stock are limited by, uh, they can only sell for two weeks after each time the company makes its management financial report or its audit report.

So, it understands standard Regulation A+ that's the annual audit, six monthly management financials. Okay. So, they only have a short window. And in that window, they're only allowed to sell less than 1% of float per day. And guess what, if you're not listed anywhere there isn't much floats, right? So, then we get into what I'll cover in a few minutes, the post listing opportunities that exist. So, but you know, be aware there's a hell of a lot of wonderful liquidity options here that you may or may not want. You can control them, but they do exist in terms of a side effect of doing a Regulation A+. So, I'm going to talk to the one that I find the most interesting really. Um, of course you can fashion direct liquidity to the investor in a Regulation A+ Um, but that's not what I'm going to talk about.

You can do that within, within reasonable constraints. And that makes it easier to raise the money because investors could see that if they pressed for cash, they'll probably be able to get so some roll on their money back. But, uh, and I can dwell on that. I can get back on that later if you guys need me to, but what's happened. It's been ages coming. Let's face it Christ you know, the whole Regulation A+ awareness thing is still it's. This sort of best kept secret after five and a half, five years and a quarter on a, in a bag and being used. Um, they're all now these exchanges that I'll call ETS is alternative trading systems, which are light broker dealers. They're there. Uh, and they are allowed to buy, uh, to, to establish markets for Regulation A+ securities. And there are quite a few of them doing that and they're happening now.

You know, I'm getting regular calls from any actually emails from these guys asking me to brief me because they want, you know, our companies to go list on their exchanges. I love this. I love this because these Mo these exchanges, they don't really solve the insider problem, right? I mean, the momentum is very sorry. The volume isn't high enough to dissolve that issue, but the volume is not the volume. Excuse me. The point is that let's say, uh, well, the point is that you can list your shares very easily inexpensively, and people can buy them and sell them. And there's no naked shorting, right? The big issue with being listed on the OTC markets or on the NASDAQ when you were a pre-revenue company. And, you know, you have sporadic news because you waiting on the FDA clinical trials, this is a hell place to be, unless you, you know, it really is a hellish place to be, because guess what?

You may know this, but I'm going to mention this because I didn't know this until the first batch of Regulation A+ IPO's one time. And I was studying while they were getting hammered in the aftermarket. The truth is that stockbrokers are allowed to short, newly listed, but they can listen. They can short any stock. That's publicly traded without borrow. They don't have to get borrow. So, any stock that's out there and especially newly listed stock is super vulnerable to being hammered. That is a big, big reason. There are so many broken public companies. Of course, there are other reasons I don't mean to defend the flaky companies that are out there, but you know, my recommendation to you is rarely, you know, please don't do a listing on one of the major exchanges or on the OTC markets, unless you are thoroughly prepared with news announcements, stacked up and an internal strategy to some have conditioned the markets.

But when the hell do you have that in a biotech company, that's, pre-revenue really difficult situation. So, I look at these aftermarkets and by the time any of you would be doing a Regulation A+ POS with us and ready to use them, I'll have solid recommendations. I have a preliminary favorite now, but it's too early because I haven't learned about the ones that have been reaching out to me that I haven't made time to talk with because we're getting so many neat companies approaching us anyway. So, the point is that no naked shorting it simply people who are investors buying and selling. And during the Regulation A+ , you can list as long as you've got typically more than 2000 investors already, which means, you know, you've raised, you raised some money and your Regulation A+ one of the ones that I like is the preliminary basis. They will require companies that use this system to do management financials monthly, right? That plus a modest listing fee plus, more than 2000 investors, which most passes guests. Uh, and you can list even Joel in the race. And if you want to do it during the race, then the marketing of the race will support the price to the aftermarket. And afterwards, you know, you want to market the company. Anyway, if you want to support the aftermarket, you could do every year, a small Regulation A+ to promote and raise the share price. If you chose to, to help provide better liquidity or have selling inside is up to 30%. All the Regulation A+ going to be selling inside is anyway. I think you guys are aware of that. Okay. So again, if you have questions on this stuff, come back and ask me, put them in the, in the chat box. If you can find it, it's under more, if you click on the button towards the bottom, right? It says more, one of the options is chat, which really means five of five, a message type of question. And young rod who is young and old can see the messages. Okay. Kate marketing. Anyway. Right? It doesn't matter that you don't have a product that gift.

Covered all the important things there. Next item. I'm going to mention Regulation A+ fast advantages to do an IPO versus a, an S one IPO here. So essentially there are really a couple of big advantages. One is that the marketing of the offering itself creates a lot of brand ambassadors, um, which is helpful, right? You can't do that in an S one. That's very, you know, it varies according to the nature of the company and how valuable that one is. Another one is that in a, in an S one IPO, let's say you have to raise $12 million to list them and ask back and reach a point where you underwriters come back and say, you know, we're at 9 million. We can't make 12. Uh, and they're not willing to change anything. There's nothing to do to improve it. Then guess what you're offering failed all the expense, which was significant, uh, has been incurred, but you can't bring in $1, you had 9 million lined up that you can't close on.

Any of it, that would be the ultimate frustration, of course, in a Regulation A+ IPO, you are allowed to close the investors that you go up. The fact, Nope. My general recommendation is it depends on the climate and it depends on the company, right? If your company is so compelling that we provide a service of lining up underwriters for a Regulation A+ IPO, if you want to do that, if you want, and we can help you find them to qualify and see if your company is worth it, we'll get the right attention to do an IPO via Regulation A+ or S one for that matter. So that's a service we do offer. But my point is that at the beginning, a lot of the companies, essentially the underwriters have it too easy at the moment. And they're saying things like, yeah, raise 8 million and get some strategics and then come back and we'll do, we'll do your offering with great pleasure.

Right? That's the sort of thing that you will hear in many cases. So, yeah, right. We can raise the 8 million, then a Regulation A+ . Why not close the money? And that's a significant advantage. If it turns out for some reason, the IPO couldn't complete ban, it doesn't matter. Cause we closed. We closed a lot of money along the way. And you know, it wasn't a waste of time. The other big advantage is that the service providers, especially the auditors and the securities attorneys charge a hell of a lot less when you're doing a Regulation A+ than they do when you're doing a Aswan IPO drastically lower prices. And you don't need PCOB audits in your Regulation A+ that you intend to list on the NASDAQ post listing on the NASDAQ. Then the first quarter after listing, you have to have a PCA or B audit, but you don't have to have one just in case ahead of time, your U S gap, or that is enough.

So, you save a lot of money in audit and securities attorney’s fees, and you have that flexibility to close the money for Christ's sake, which, you know, let's, let's make sure we bring in money versus almost bringing it in. Those are the, those are the advantages. The disadvantages it's capped at 50 mil. If you, your company couldn't carry more than that in a, in an S one IPO, if you could raise 300 million, you should do it with an S YPO, the underwater support that goes along with that, that's uh, you know, we, aren't doing Regulation A+ IPO's raise 300 nos. We're not allowed to. Okay. So cover that mistakes, avoid some of these I've talks on, but you know, I want you to be aware of them, misfit companies, the single biggest reason why companies have failed in Regulation A+, because Regulation A+ was never going to succeed in the first place. It was never the right instrument. Right? So, use us as a sounding board, whether are you going to work with us or not within reason, you know, we don't want to entertain casual conversations that have no chance of anything good coming from them. But you know, I'm happy to give advice point being there's been so many companies that did Regulation A+ findings and then fell on the noses because it was never going to work. It was always a company that was preordained to fail in a Regulation A+ context. It could be a fantastic company, but that doesn't mean Regulation A+ is the right instrument.

It's not just about having a fantastic company. It's about having a fantastic company, which has the right characteristics for Regulation A+ to click and be a good instrument to use. Right? That's been the biggest source of failed Regulation A+ is the second one has been do it yourself, companies that think they can put it all together themselves and learn that they can't. So, don't, I recommend you don't do that. You work with someone like, or one of the other companies that help with the Regulation A+ process. I think we're the best of course, but I'm a tad biased in that. Okay. Hi, minima mask, bro. So, companies will sometimes convince themselves that they really shouldn't do it. If they don't raise more than $8 million. And then you've got this horrible cashflow burn to reach a million dollars, if it's legit, cause you're buying a built building.

Why that wouldn't be too relevant biotech would it, but if you're buying a company, then that price is 8 million. The company has nothing until you hit a mill. That's an it shouldn't that reason to have an escrow account and raise eight mil as long as, as long as you can afford to raise it by law of expense. That's uh, that is a seriously expensive mistake to make. If it, if it was not needed, establishing a, excuse me, establishing a high minimum amount per investor for any reason is a bad idea. You know, I've had companies approach us to work with us where they're already qualified and they set a minimum of five or $10,000 per ambassador because they're thinking the thinking like the old days, when you raise your money for rank D investors and I had to refuse, unless they would change that number down, which you can do actually, because there's no way in hell we can add any value.

You know, a reg a Regulation A+ with a minimum of five or $10,000 is preordained to fail. The average investment amount will be $10,003 and nobody will invest. That's just a fact of life you need to, when you went, when you recognize the mechanism by which we raise money, it is reaching out to people to bring them into an offering page with some compelling message, right. Cure Alzheimer's that's a little bit, we wouldn't probably be able to say sure Alzheimer's unless it was a lot of proof, which you wouldn't have to prove, but yet the, just something motivating brings them in. They go to the offering page. What do they want to see on the offering page? They want to see am I really allowed to invest in this? Can I afford to invest in this thing? I haven't even evaluated yet. And do I like it, right?

If it's, if the minimum is five K at this instance, I'm a real casual visitor. And I'm thinking 5k, no way I leave and never come back. Right? That's what happens if you have a low minimum, you know, not ridiculously low, let's say $300, $400. Then these people punish you. And these are regular people. Remember, but they're not accredited investors in the main, the regular, regular people. You'll have some disposable income. We believe in what we're doing. We really want to back us. I'm saying us as a part of your team and I can't even see you, you know, but you know what I mean? I can see three of you. That's a good star.

The point is that the dynamic of bringing in people through social media or advertising, which is what we do that brings in investors that are going to find the offering. Interesting. It's got to be at the moment they arrived, but it's really casual. If you can get them to stay for 10 seconds by not rejecting them by some obviously stupid moves, like having a high minimum Lam, we want to keep them 30 seconds because the content is compelling. We've got them for 30 seconds. We want them to stick around for a minute and a half or so. And then, you know, then we're able to really good chance to raise money from right. It's a progressive sequence of events. Some of them don't need the minute and a half of attention, but anyone that comes in from an a, they were doing something else. Remember, you know, think about it that way. They are generally on a quest to find our company. They're doing something else. They get interrupted by an ad. That's interesting. It's still an interruption. We got to make sure that it's really compelling for the first 10 seconds. Don't blow them off with a minimum investment in mind that will kill it, kill it dead.

I spend too long on that. How are we doing on time? I think we scheduled three hours for this, so we're good. I'm joking. Of course. Okay. So, um, relying on a broker to raise the money at the front end is a complete waste of time in almost every case, unless it's your brother and he cares about you so much, and he's going to make it happen because he's your brother. He's got to deliver. Otherwise, you'll fire his.

I'm British. You know, if I had my free, will I be swearing profusely as we go along here, I'm trying to moderate that characteristic. Okay. So, do it yourself. I said, it's a bad idea. It is the most. We get companies that approach us and they now, I started to recognize that characteristics that ended up being do it yourself. And the only rewarding thing for me when they implicitly reject us, which me off is that they fail. They don't usually succeed. So at least I feel slight if they had gone off on their own at a blistering success, wouldn't feel that's me being eager too. But Hey, I'm going to give him a B for human being as a law firm, big auditor. You know, we had a case where a practice knowledgeable law firm doing a security offering charging 50 K got replaced by a giant law firm. And they could know what they didn't know what to do. And came back to her and asked her help. And they charged an amazing amount of money, a real estate company that had just qualified, approached us. They had spent $300,000 in legal fees getting qualified with the sec, just that when we can get you as a great securities attorney to do that for 40 50, or okay, right. For a real estate offering, it might be a bit higher, but 40 or 50, maybe 60 K. Right. That's the sweet spot for really qualified smart attorneys to do this. I mean, I'm not believing in that the big law firms do charge well, that's okay.

They're worth it in general. But you know, sometimes it's silly bugger numbers, you know, $300,000. And not only that, it took months, it delayed the whole thing, right? Wasn't just the cost. It was the delay. The auditor please don't do that. We had a company planning, an IPO, super the route, the NYC rolled out the red carpet to us back in 2017, 18. This was, is a super company, but the CEO was insistent in his use of Deloitte. And he had an, he had an entity in the U S you had one in Singapore and one in India never came through with an audit in time for us to get the sec filing sorted, not once the complexity of it, you know, in that situation with a giant auditor and a dinky little client, they don't put a level teams on, they put B level and C level teams on you wasting humongous amounts of money, and you just don't get any results.

So that was an extreme case. His board told him to terminate the Regulation A+ and that's fine, whatever ideas he had about that. So, at the window, because of this attachment to Deloitte lovely Deloitte company, you know, for the right customer, but not for this situation, tier one Regulation A+ is a complete waste of time. It's virtually never a situation that it's useful in 2019, slightly over a billion dollars was raised by a Regulation A+ 4% of it came in into one piece. And I think it will be 2% in 2020 of that billion, 65% was real estate. The big raises tend to be real and stuff, but my, in my intention and belief, because we're doing a number of really exciting biotech companies, it's taken too long to get a lot of pirate biotech companies. Partly because I didn't do webinars like this one focusing on biotech, but now we've got a good, good pipeline to me that biotech is a sweet spot and it's not dependent on a real estate cycle because we will say it isn't always going to be in a lovely cycle.

I don't like that. Cyclicity okay. Us only though we want to raise money outside. It's less expensive to find investors outside the U S much, much less expensive. So, let's not be us only, um, Donald I debit credit cards because we're afraid bringing it using debit and credit cards makes it so much easier for people to invest that done in four to six minutes. And, you know, ACH is an alien concept to a lot of millennials, right bank. They don't have a checking account for having to say the idea of ABA numbers and account numbers and things is a really Catholic, you know, is, is, uh, is not cool. They're into Apple pay, right? So, it's a bad idea not to allow debit and credit cards. A lot of companies are too intimidated by how many investors they have. I'm going to waste time on it, but it isn't as bad as you'd think you use the transfer agent to handle that all the detailed stuff.

You need to have a transfer agent on a Regulation A+ for a variety of reasons. Anyway, thinking it's remote control. The service providers could do it all with never going to be that way. There's got to be engagement from internally. There's a lot of the things that I'm going to want the CEO or spokesperson to do to generate better and better engagement or less and less expense. Okay. It is not remote-control stuff. We do the lion's share of the work with the service providers, but there's a lot of work. You must do neglecting social media comments. Some I won't belabor it, but there's a serious need for that. That takes some degree of time, depending on how excited people are, how many comments there are committee decisions, making bad decisions.

These are in the wrong security. I won't belabor that, but that's the sort of thing we help with this, to the extent we're allowed to we'll nudge you in the right direction without telling you what you should do. Cause we're not allowed to reverse mergers. Like, you know, we have a company right now. That's a biotech. Almost. They came to us when they were almost qualified and they realize that as in there and they're filing and, uh, they are extracting themselves from a reverse merger that they did thinking it would make it easy, which is not the case. Generally speaking in a Regulation A+ post-contact you don't need to have done a reverse merger. Okay. That's it. If you guys want to hang on, now I'll attend to the questions, although I don't see any, but that's because I'm going to be in the bottom of the stack. Okay.

If one is ready to start trials, Regulation A+ delays you, where am I missing something on the timing? Well, if you don't need the money, don't use Regulation A+ if you need the money and use the right game, plus if you get, if you have other sources of capital, like VC that are interested and you need them, if you need it instantly, and you've got it available, take the money early nine two in the Bush. I understand the need for professional advice you provide. But in general, is there a, is there a litigation risk with a lot of non-accredited investors? I would say to my mind, the, the litigation risk is lower because of a lot of non-accredited investors. It's not worth their while, then litigation happy type people. They're optimists. You get more risk from accredited investors, frankly. So far, I haven't seen any litigation from anyone in any Regulation A+. There might be some that I'm not aware of, but I think I'd be aware by now. So we're ready. Okay.

Those 10 to 14% included 150 K per audit. Well, if it was 150 K for audit and legal, then that would be silly, expensive. I would say audit. I mean, it depends on the audit, right? I mean, you can have a a hundred K audit because it's absolutely necessary. But that, I would say if you take audit out of my estimate of 150 K and take out legal, because you have somebody you want to spend a lot of money on then, but, but actually, Oh, actually, yeah, you, now I realize I misunderstood your question. Yes. It includes all expenses. It does include, it includes all expenses, but it wouldn't be 150 K for audit and legal, 150 K's or that number I estimated for you is all the expenses to get live on less. You make the mistake of bringing in super expensive providers in order to legal or anywhere else. And it assumes a simple audit. Okay. Well, long one here. I'm going to see does not verify or to show that. So, I'll just claim her. Yeah, there you go. I don't think I want to read that as a question. Do these classes too long.

Okay. Hi, Roy. I can hear you just fine. Thank you. Is that it? No more questions or one new message here. Alright. Premium is for directors and office insurances have skyrocketed for public companies. Do Regulation A+ have the same DNO insurance requirements for, as for public companies? Well, I am not an expert on the inner costs. I was recently approached by a service provider that I haven't spoken with that provides DNO at a, they say much more efficient costs, but, um, I think there may be an opportunity. It's a heck of a lot lower risk to be a Regulation A+ offering that completed than it, than it is to be a listed company. Um, I think from a litigation standpoint. So, it makes sense logically that DNO insurance would cost less, but that doesn't mean that's going to happen. Right. You know what I mean?

I've got a pain here. Bear with me a second something else. Okay. So actually, we don't have any more questions, uh, user privately. I don't see that. Yeah. Oh, how come? How did companies keep engaged with their investors? Post-funding Oh, this some other questions I didn't see. Okay. So, um, I recommend quarterly phone calls better. Yet. Video calls is a super benefit to looking in the eye of the camera, which is looking in the eye of the, of the investors. I think that's a super benefit, frankly, and doing it in a non-bill long sales-y manner. You know, open kimonos style is good. Obviously, you don't want to create litigation exposure, but flag the offering. And after the offering, having regular exposure to the investors is irreplaceably good because you want them to be interested in aware you want them to feel like they're a part of a journey.

Many of the investors in a Regulation A+ process are doing it for vicarious engagement reasons. They want to be a part of an offering. They want to be a part of it. They like your team. They selected your team. They want you to prove them, right? When you do a Regulation A+, are you only registering your offering of non-issue stock or you're only registering the shares that the Regulation A+ is offering, um, how inside the shares included they aren't, they aren't included in the offering unless they are list inside unless you have selling shareholders. But the sec considers all security holders that have surpassed the rule. One 44 holding period is liquid. So, what you would do, if you want to make your, all of your shareholders liquid and the best possible way you would pick the best post Regulation A+ marketplace and put all, let's say there's five securities that you have that are part of your company and list all of them on that market. That would make it easier for them to sell them as they are. Right. That's the way to do it. Um, it isn't costly much at the moment the costs I'm sure they'll stay low because there's so many of them already, it's going to be a pretty crowded space.

If one is ready to start, that's why that's so, so there are no more questions here. Okay, good. So happy to receive email questions from you guys afterwards. I hope this is useful. The one Dan side of this stuff is I'm broadcasting. And I can't tell if you like it, if it's worthwhile, if I'm missing the point, if, because you refer to the disclaimers and, uh, engage with the sending emails via, you know, any of these, the access ones, including the invitations to this event, if you have questions and, um, we'll be working together on some of your companies as we go forward. Um, what else? Thank you for all your work. You're making this happen. And as I said, there will be a recording of this with a clickable index that will be a blog post. I will send you a link to it within a few days or a week. So, you'll have access to that. And, um, that's about it for me for now. Yeah. Thank you very much for your attention. And again, I hope this was useful. Cheers guys.

THIS TEXT TRANSCRIPT HAS ERRORS IN IT THAT WERE CAUSED BY THE SPEECH TO TEXT CONVERSION SOFTWARE WE USED. DO NOT DEPEND ON THE TEXT TO BE ACCURATE. WATCH THE RELEVANT PARTS OF THE VIDEO TO MAKE SURE YOU ARE PROPERLY INFORMED. DO NOT DEPEND ON THIS TEXT TRANSCRIPTION TO BE ACCURATE OR REFLECTIVE OF THE STATEMENTS OR INTENT OF THE PRESENTERS.