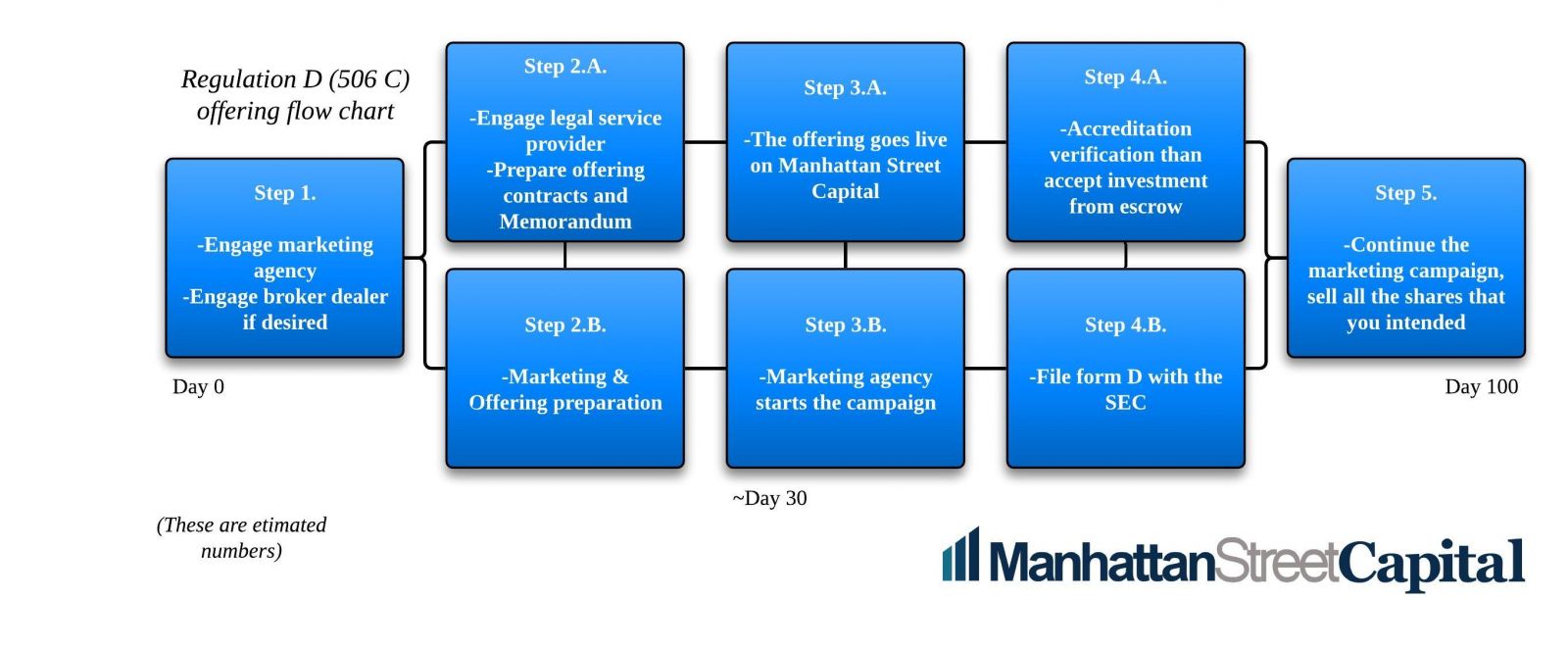

- 1. Chose a marketing agency that will manage your 360° marketing campaign. We will introduce you to experienced marketing agencies. In the case of a Reg D offering, you are not required to use a broker-dealer, but if you choose to involve one you should definitely do it early. We will introduce you to appropriate broker-dealers if needed.

- 2.a Engage a legal service provider to do your SEC filing. We can introduce you to good service providers. Reg D is generally well understood and simple to set up.

- 2.b The marketing agency builds your offering pitch on Manhattan Street Capital, video, PR, graphics, social media accounts, advertising.

- 3.a The offering goes live, the investors can purchase your shares and deposit their money into escrow.

- 3.b Start the 360° marketing campaign.

- 4.a In the case of a Reg D 506C offering, the Issuing company has to take reasonable steps to verify that its investors are Accredited. Manhattan Street Capital will assist with this process by using a third party specialist service. Since Regulation D doesn’t set a dollar capital raise limit to the issuer company, your company is able to raise an unlimited amount of money in theory, in some circumstances. There are specific restrictions that apply in some circumstances (get legal advice).

- 4.b File Form D with the SEC. Form D is a filing that does not require you to wait for SEC Qualification.

- 5. Continue the marketing campaign, raise the capital. Complete the process.

Notes:

This is a Summary schedule that is condensed and simplified. There are many aspects of the schedule that are adjustable according to confidence and success level.

Related Content:

How much does a Regulation D offering cost?

Can I do a Reg D 506c on Manhattan Street Capital?

What is the difference between a Main Street Investor and an Accredited Investor?