Generational wealth

Oil and gas creates continued revenue that can return generational wealth. But with those intense ups and downs, it isn’t the safety net it used to be. So, then, what is?

Duplicating the most profitable energy model ever invented.

Duplicating the most profitable energy model ever invented. Inflation-countering asset that isn’t already at an all time high.

Inflation-countering asset that isn’t already at an all time high. To transform the most valuable commodity in the world.

To transform the most valuable commodity in the world.

Some used to call oil “black gold.” Incredibly valuable, always in demand – but then 2020 happened, oil tanked, and we learned our lesson. But yet many still invest in oil and gas. Why?

Oil and gas creates continued revenue that can return generational wealth. But with those intense ups and downs, it isn’t the safety net it used to be. So, then, what is?

The answer is water – something we will never stop needing, and it’s only growing scarcer. An invaluable asset to survival – and it’s quickly becoming the stable, new asset class that investors are flocking to. It’s the new gold, and, unlike oil, it’s set to leave the world better than we found it…

Water is an ever-expanding, trillion-dollar, global industry - and now you can invest directly in water production for the first time in history. It’s literally Water Like An Oil Well. Now, you might ask: doesn’t the government handle all our water treatment?

The government can’t keep up with demand, central water infrastructure is breaking down, and we’re facing the consequences. But there’s a bright side to this, and it’s one you can benefit from tremendously. First, let’s take a look at the problem… and the investment megatrend stemming out of it…

Droughts, toxic drinking water, broken sewer mains— a laundry list of water problems make the news, what seems like every week. Why is this happening?

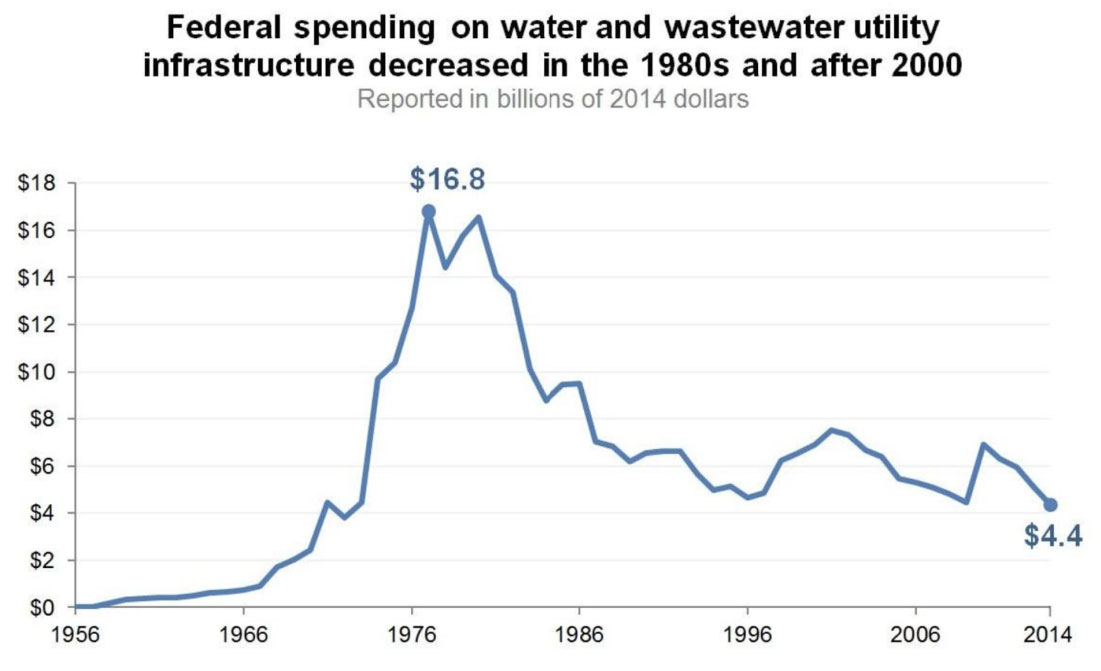

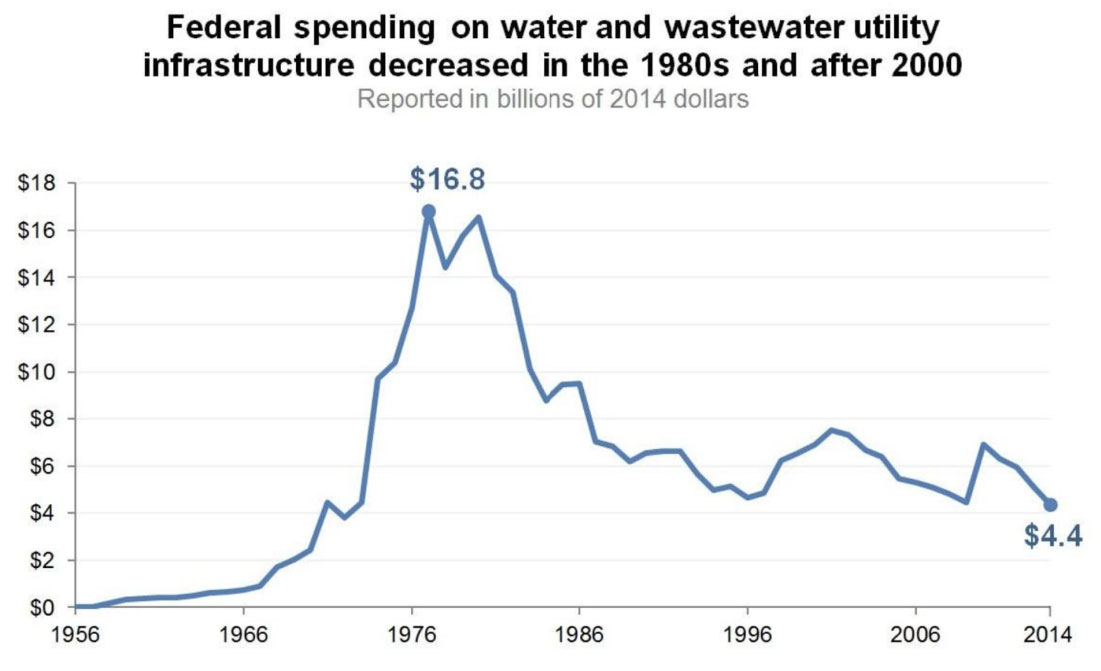

The reality is that the federal government has been reducing funding to cities and counties for decades. That’s 100,000+ water systems that can’t handle the job – and it’s only getting worse.

What about the infrastructure bill?

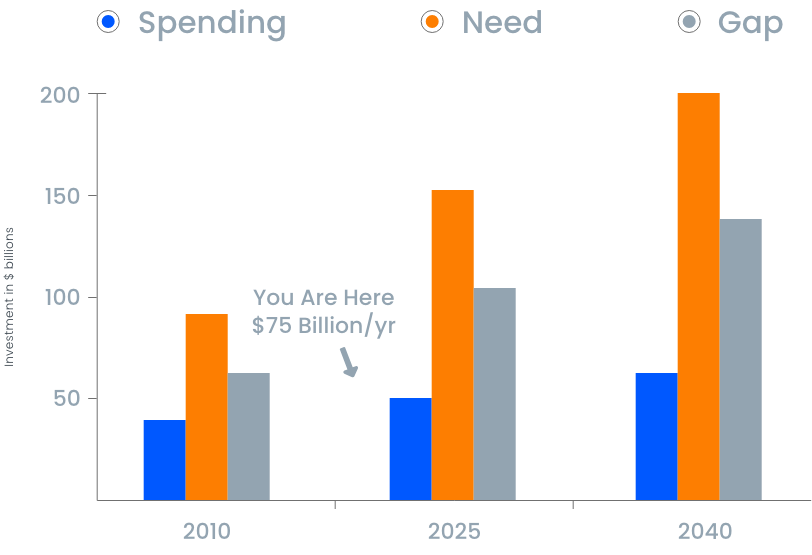

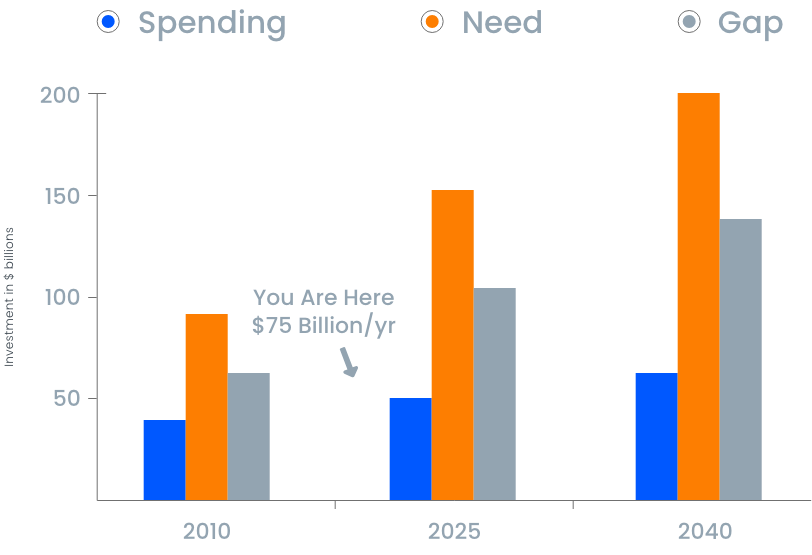

In the recent infrastructure Investment and Jobs Act, a “once-in-a-generation investment in our nation’s infrastructure and competitiveness,”, Washington approved $55 billion for water. Will that do the job?

As you can see on the graph to the left, we’re falling behind by $75 Billion a year. once-in-a-generation? Not even close! That’s less than one year’s worth of backlog.

So… what happens now? Who pays for all this? The cities and counties are out of money, and Washington isn’t helping anytime soon…

If left unaddressed, the investment gap is slated to become $105B/yr over the next decade

If left unaddressed, the investment gap is slated to become $105B/yr over the next decade Cost of repairs and upgrades are mounting, and government handouts won’t be the answer

Cost of repairs and upgrades are mounting, and government handouts won’t be the answerThat’s the unfortunate reality. Cities are now dumping the burden of wastewater treatment on local businesses that can’t afford it. After all, agriculture and industry combined are responsible for 87% of all water usage. Make them clean up their own messes, right? The question is: how?

Income + Assets + Equity

*The features and benefits of this offering are a combination of the OriginClear Series “Y” offering with

planned Water On Demand Inc. Series “A” allocation for all Series “Y” investors.

Terms and Conditions | Disclaimer

Well, you know what comes next. Yep, they’re now making private businesses clean their own water. Why not? After all, agriculture and industry, together, are responsible for 87% of all water usage. Make them clean up their own messes! Right?

And that’s exactly what cities and counties are doing all over America, right now.

“Don’t send us your dirty water. Send us only treated water!” they demand.

It’s been more than 20 years in the making…and now we’re making it a reality.

What is the current Water On Demand™ investment?

An investment in Water On Demand consists of royalties on water assets, plus a dilution-protected founder’s share of the new Water On Demand Inc. (WODI) spinoff. And, a grant of public stock in the parent company that guarantees a 150% ratio on your investment – plus double rights to a future investment at a locked price. For a short time, receive a 165% institutional conversion on your investment.

What is the total of the offering?

We intend to fund Water on Demand up to $300 million, with $250 million dedicated to royalty-bearing water assets. Only the first $20 million will qualify for the Founder’s Shares in WODI. The ratio of investment to founder’s shares will reduce over time, as well.

Who can invest in the offering?

Only accredited investors may participate.

What is the standard investment?

Each unit is $100,000, however, units can be subdivided, and the minimum investment is $10,000.

What is the minimum investment?

Accredited US investors can invest as little as $10,000.

How do I convert to common stock?

For the publicly traded stock in the parent company, you can convert at any time. One reason to do it might be to capture the current relatively low price. This is effectively a measure of downside protection and you are protected on the upside by a ceiling of $0.25, which is subjecty to change for later investors. Please note that once converted, you have no price protection. The portion of your Founder’s Shares in WODI are intended to be convertible into common stock once WODI achieves a public listing. Until that time, the market for these private shares is limited***

When will my common stock be free trading?

For public shares, simply wait six months from the date of investment.

Do I have guaranteed additional investment opportunities?

For up to five years, you have the right to invest the same amount twice more, at the guaranteed price of $0.25.

This is known as a warrant. This guarantees your price on potentially investing twice more.

You have the option to buy (or exercise) the warrant “cashless”. Cashless means you can offset the cost of the warrant with warrant shares, so you don’t have to pay any cash. You can still pay cash, to maximize the amount of shares you get.

What do you plan to use the funds for?

Of the $300 million raised we plan to invest at least $250 million in a Water On Demand™ or WOD subsidiary, for the sole purpose of investing in water projects. The equipment will be owned by the WOD subsidiary and is intended for water managed services (pay-per-gallon).

Water on Demand has already successfully transacted secured, dividend bearing loans with funds not actively invested in performing water assets. Funds are managed, not left idle.

We plan to allocate the remaining $50 million to build our ability to manage water services. The discretionary allocations do not affect your percentage of net profits which remains 25% on your entire investment.

How will you develop the ability to deliver managed services?

We intend to use our funds to develop project management and quality control capabilities, and also to contract with outside water companies for the actual building and onsite maintenance of these systems.

How Does It Work?

Step One: The Right Technology

Imagine water systems with incredible technology that you simply drop in place and your water is cleaned. No major construction, no headaches, and they can be taken out as easily as they were put in. Those machines exist, and we have them. It’s called Water Systems In A Box™r, and it’s the perfect technology for the new, fully-financed water systems for business.

What is Total Outsourcing?

We sign up the customer for a multi-year managed services contract. All they have to do is pay by the gallon, we take care of the rest. No capital expense, they just pay one monthly bill. We take care of the maintenance–everything. That’s total outsourcing.

“Pay by the month” is profitable. Have you noticed that you’re paying more by the month for Microsoft Office? But, have you noticed that it’s a better product? Managed services are sweeping the world of business, and for good reason: everybody wins.

Now it’s water’s turn. Our models show it’s both profitable and creates contractually assured revenue. Once a business commits to Water On Demand, it won’t want to stop. Here’s a snapshot from our 25-year model. With just a $20 million investment in water systems, we generate $40 million for the investors alone!

What is my profit share from WOD?

You are to receive a percentage of Net Profits, proportional to your investment, for the life of the WOD projects in which your investment resides, which is set initially at 20 years. In the event the money is reinvested in a new project, you will continue to receive the royalty. If the WOD subsidiary (capital corporation) you are invested in is wound up, you will receive a pro rata distribution of the net profits from the windup.

Is there an opportunity to earn even more than 25% net profits on my investment?

Yes, we believe these capital equipment assets can be leveraged through traditional banking. While financial leverage can be as high as 10 to 1, our more modest estimates, subject to experience, are 3 to 1. By way of example: if $100,000 in capital equipment were to generate $100,000 in royalties over 20 years, the $300,000 that it may be leveraged to could pay $300,000. In this example the investor would receive $300,000 in royalties as a result of their capital facilitating such leverage. So, even though this example only invested $100,000 they would receive the same 25% royalties on the fully leveraged asset of $300,000. How much leverage will be achieved will be confirmed over time. It is possible that no such leverage would occur.

What can you charge the WOD subsidiary for your work?

We may charge ordinary and reasonable management, operating, service, maintenance and parts and consumables fees.

How are Net Profits defined?

Net Profits are calculated according to normal GAAP standards. After all costs and expenses are deducted, including allocations of intercompany expenses and any interest expenses, but before the deduction of income taxes. Any past losses (of WOD subsidiary) will be accounted for prior to calculation of Net Profits.

If I sell my shares in either the parent company or Water On Demand™ in some near term liquidity event, would I still receive my profit shares from my initial investment?

For your water asset investment, your profit share is permanent, whether you sell the stock or not.

Who else gets a percentage of Net Profits and am I impacted?

We may compensate strategic partners or finders from Net Profits.

They are always paid, or repaid, from our profit share. Your share is not affected.

What is my security in this investment?

In the event we redeem or liquidate the WOD subsidiary, you will be entitled to receive your original investment, and any unpaid Net Profits due to you.

The payment of your right to receive a percentage of Net Profits is guaranteed by a security agreement that gives you the right to file a lien against Water On Demand to enforce this right.

Pro forma financials developed by OriginClear. Subject to change.

Deploy 35 machines

12 Micro

13 Small

10 Medium

$19,932,400

Initial Asset Value

$13,544,904

W.O.D. profit before taxes

$3,386,226

Investor profit share %p.a.

on invested capital

$677,245

Strategic partner profit share

$9,481,433

W.O.D. profit before taxes -

net W.O.D. PBT - % of revenues

$17,455,866

Total contributions to OCLN

Deploy 35 machines

12 Micro

13 Small

10 Medium

$19,932,400

Initial Asset Value

$144,482,104

W.O.D. profit before taxes

$36,120,526

Investor profit share %p.a.

on invested capital

$3,557,980

Strategic partner profit share

$104,803,598

W.O.D. profit before taxes -

net W.O.D. PBT - % of revenues

$130,714,634

Total contributions to OCLN

Did you know that you can invest directly in oil production and pipelines? It’s called a Master Limited Partnership (MLP). Invented in 1981 by Apache Corporation, it’s a great way to build generational wealth from oil exploration and production. We’ve based Water On Demand™ on those MLPs – with a better incentive structure. How?

Imagine an investment program that lets you share in profits from Water On Demand projects, while also getting a long-term stock position (and major additional leverage) in the parent company.

Your profit share is backed up by real security agreements.

We plan to index the underlying contracts to inflation ─ to protect you from loss of value.

This model has the potential to pay you monthly residual income for up to 25 years.

We’re working on accelerating income payments for those who need it faster!

We’re out there talking to the financial world about the clean water problem.

We are a company of water tech experts and disruptors working to transform the clean water industry.

Riggs Eckelberry is the founding CEO of the innovative water technology company, OriginClear. Riggs is the visionary designer of Water On Demand, which is enabling investors to invest directly in water projects for the very first time.

Marc Stevens founded Progressive Water Treatment (PWT) in McKinney, Texas in 2000. Over the last twenty-two years, Marc has built a solid, profitable company with an outstanding customer reputation. On 1 October 2015, OriginClear closed on the acquisition of PWT, making it the first member of the newly-formed OriginClear Group.

Tom Marchesello joined OriginClear after a successful transformation of the early Modular Water Systems™ group into a streamlined, operational model with manufacturing of a branded modular water treatment product lineup. Tom has been a leading voice for innovative companies with strong ESG (Environmental, Social & Governance) based business.

Prasad Tare brings more than fifteen years of experience in public accounting, financial reporting, risk, and internal controls advisory services to OriginClear. His skill set includes company-wide risk assessments to improve focus to critical areas, as well as more efficient and effective audit activities.

In January of 2022, Ken Berenger was recognized as co-creator of the breakthrough water asset investment program, Water On Demand™, and received a promotion to Executive Vice President, OriginClear. Ken has over twenty-five years of banking, investment, consulting, sales force training, and corporate finance experience.

Dan leads OriginClear's engineering activities through the design and development of the Modular Water™ (MWS) product line of prefabricated and prepackaged water treatment and conveyance systems utilizing Structurally Reinforced ThermoPlastics (SRTP) materials. Since 2010, Dan has specialized in the research, development, and deployment of next-generation water infrastructure technologies using heavy plastic manufacturing. His initiatives and innovations led to the granting of six patents issued in his name for various inventions related to these infrastructure products. His vision represents the basis of Modular Water’ product line.

OriginClear Inc. (OTC Pink: OCLN), the Clean Water Innovation Hub™, announced the launch of its $300 Million offering on the crowdfunding site Manhattan Street Capital: www.manhattanstreetcapital.com/originclear. Water On Demand is designed to offer clean water systems to businesses and communities as a managed service and without any capital requirement.

Ken Berenger, Executive Vice President, made the announcement last week at the Prestel & Partner Family Office Forum Conference in London. He reported on his experience, and played an excerpt from his presentation, on the company’s weekly CEO Briefing last Thursday: https://youtu.be/XHOS7dKjW_8

“This is the first time that we have presented our Water On Demand capital offering to family offices and Ultra High Net Worth Individuals (UHNWIs),” said Ken Berenger. “We believe that these investing groups will complement our loyal accredited investors to enable us to reach this very ambitious funding goal. In fact, it was one of our own loyal investors, a delegate to the forum, who promoted our appearance at the forum.”

The company believes that Water On Demand is the first organized program to enable investment in Water Like An Oil Well™, similar to Master Limited Partnerships (MLPs), which are now a $300 Billion+ sector that complements the large energy companies. Just like MLPs, Water On Demand investors could earn long term royalties from bundles of water projects.

Water On Demand has dedicated initial funding and is currently qualifying candidates for its commercial pilot program.

THE SECURITIES OFFERED HEREBY HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”), OR ANY STATE SECURITIES OR BLUE SKY LAWS AND ARE BEING OFFERED AND SOLD IN RELIANCE ON EXEMPTIONS FROM THE REGISTRATION REQUIREMENTS OF THE ACT AND STATE SECURITIES OR BLUE SKY LAWS. ACCORDINGLY, THE SECURITIES CANNOT BE SOLD OR OTHERWISE TRANSFERRED EXCEPT IN COMPLIANCE WITH THE ACT. IN ADDITION, THE SECURITIES CANNOT BE SOLD OR OTHERWISE TRANSFERRED EXCEPT IN COMPLIANCE WITH THE APPLICABLE STATE SECURITIES OR BLUE SKY LAWS. THE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SEC, ANY STATE SECURITIES COMMISSION OR OTHER REGULATORY AUTHORITY, NOR HAVE ANY OF THE FOREGOING AUTHORITIES PASSED UPON THE MERITS OF THIS OFFERING OR THE ADEQUACY OR ACCURACY OF ANY OTHER MATERIALS OR INFORMATION MADE AVAILABLE TO SUBSCRIBER IN CONNECTION WITH THIS OFFERING. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL.

THE SECURITIES MAY ONLY BE PURCHASED BY PERSONS WHO ARE “ACCREDITED INVESTORS” (AS THAT TERM IS DEFINED IN SECTION 501 OF REGULATION D PROMULGATED UNDER THE ACT).

THE [OFFERING MATERIALS] MAY CONTAIN FORWARD-LOOKING STATEMENTS AND INFORMATION RELATING TO, AMONG OTHER THINGS, THE COMPANY, ITS BUSINESS PLAN AND STRATEGY, AND ITS INDUSTRY. THESE FORWARD-LOOKING STATEMENTS ARE BASED ON THE BELIEFS OF, ASSUMPTIONS MADE BY, AND INFORMATION CURRENTLY AVAILABLE TO THE COMPANY’S MANAGEMENT. WHEN USED IN THE OFFERING MATERIALS, THE WORDS “ESTIMATE,” “PROJECT,” “BELIEVE,” “ANTICIPATE,” “INTEND,” “EXPECT” AND SIMILAR EXPRESSIONS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS, WHICH CONSTITUTE FORWARD LOOKING STATEMENTS. THESE STATEMENTS REFLECT MANAGEMENT’S CURRENT VIEWS WITH RESPECT TO FUTURE EVENTS AND ARE SUBJECT TO RISKS AND UNCERTAINTIES THAT COULD CAUSE THE COMPANY’S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE CONTAINED IN THE FORWARD-LOOKING STATEMENTS. INVESTORS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE FORWARD-LOOKING STATEMENTS, WHICH SPEAK ONLY AS OF THE DATE ON WHICH THEY ARE MADE. THE COMPANY DOES NOT UNDERTAKE ANY OBLIGATION TO REVISE OR UPDATE THESE FORWARD-LOOKING STATEMENTS TO REFLECT EVENTS OR CIRCUMSTANCES AFTER SUCH DATE OR TO REFLECT THE OCCURRENCE OF UNANTICIPATED EVENTS.

Comments

Post comment